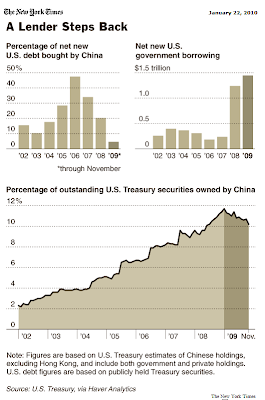

THE United States government borrowed more money than ever before in 2009, but its largest lender — China — sharply reduced the amount it was willing to lend.As America's current account deficit declines, especially with China, there will be a scarcity of dollars to support the Treasury market. This is one of the many reasons why the Fed has taken on the onus of directly buying debt. The graph below shows the troubling trend of our #1 banker giving us the cold shoulder.

The United States Treasury estimated this week that during the first 11 months of last year China raised its holdings of Treasury securities by just $62 billion. That was less than 5 percent of the money the Treasury had to raise.

That raised its holdings to $790 billion, leaving it the largest foreign holder of Treasury securities — Japan is second at $757 billion and Britain a distant third at $278 billion. But China’s holdings at the end of November were lower than they were at the end of July.

The Mythical "Household Sector"

During the full year of 2009, the volume of outstanding Treasury securities owned by the public — as opposed to United States government agencies like the Federal Reserve or the Social Security Administration — rose by $1.4 trillion, a 23 percent gain, to $7.8 trillion. In dollar terms, that was the largest annual increase ever, but as a percentage increase it slightly trailed 2008.The public sector is very broad, and includes a household sector that isn't adequately defined. Essentially, the household sector, which accounted for about half of the growth in public ownership of debt, is comprised of all Treasury purchases outside of the standard categories (government, foreign, pension funds, money market funds etc.). In all likelihood, the household sector is a front for direct government purchases.

But total foreign purchases in the 11 months financed only 39 percent of the borrowing, leaving American investors to purchase the remainder. As recently as 2007, foreigners were buying more Treasuries than the government was issuing, enabling Americans to reduce their Treasury holdings even as the government borrowed hundreds of billions of dollars.

Foreign governments around the world are dealing with their own domestic economic issues, which obviously weakens their ability to purchase our debt. This will exacerbate the funding crisis in America as our issuance of debt increases.

The debt situation is a lot more delicate than most people realize. I don't know how much longer the Fed can get away with this con game, but I suspect it will come to an end soon via a sharp increase in yields.

This post has been republished from Moses Kim's blog, Expected Returns.

1 comment:

Just Read Martin Jacques "When China Rules The World" -- quotes Ken Rogoff as saying hegemony will be much more expensive if the dollar falls off its perch as the dominant reserve currency.

Post a Comment