I'm starting to realize more and more that peop

le are firmly entrenched in their respective gold bull or bear camps. As such, it's extremely difficult to get what I would consider an objective opinion; there is just way too much emotion involved at this point.

le are firmly entrenched in their respective gold bull or bear camps. As such, it's extremely difficult to get what I would consider an objective opinion; there is just way too much emotion involved at this point.Everyone knows that I am bullish on gold. However, I never want to reach the point where I feel I am a "gold defender", since I know taking on this position will invariably cloud my judgment. I simply want to maintain my objectivity and make the right play. Trust me, I don't have any special allegiance to gold; I simply see tremendous value at the present time.

What we call "value" is in a constant state of flux. Think about it- simple currency movements can distort data and result in gross misinterpretations. Taking this into account, price analysis is just about the most elementary form of "analysis" you can do. Unfortunately, simple price analysis is about as far as most people are willing to go.

Now let's assume you have no position in gold. What's one of the first questions you should ask? Simple. Is gold in a bull or bear market?

If we pull a long term chart, it's quite clear that gold is in a bull market. There's nothing in this chart that remotely suggests we are in a bubble. Above $800 and the bull market in gold is intact. I don't think there is any controversy here.

As for gold shares, we are seeing the type of accumulation that characterizes bull markets. Following the panic lows in 2008, GDX is up over 200% on volume. Amazingly, we still have not breached the record highs seen in 2008.

Dow: Gold Ratio

The Dow:Gold ratio is a rough measure of the relative value of gold vs stocks. In the past 3 bull markets in gold, the Dow:Gold ratio fell below 3. The Dow:Gold ratio peaked at 44 in 1999. Since then, gold has outperformed stocks by a factor of 5. Historical precedent suggests gold will continue to outperform stocks in the foreseeable future.

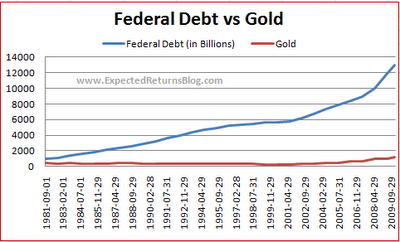

Federal Debt vs Gold

The following chart probably has the biggest implications for gold moving forward. Federal debt was relatively stable until the high interest rates of the 1980's caused our debt to explode exponentially. The federal debt is inherently inflationary since the majority of our debt is serviced by foreigners or outright monetized,

So what is the overvalued asset here? If anything, we are witnessing a huge bubble in government debt that is about to pop. Gold is simply rising in response to excessive government spending and has a lot of "catching up" to do in the years ahead. To me, this is a clear bull market.

This post has been republished from Moses Kim's blog, Expected Returns.

No comments:

Post a Comment